Business Review

Robinsons Retail achieved Php192.1 billion in net sales in 2023, a notable increase of 7.4% supported by blended same store sales growth (SSSG) of 3.9% and store expansion initiatives. Despite the impact of inflation on consumption and a challenging base in 2022 which benefitted from economic reopening and election-related spending, the company continued to demonstrate resilience. The primary drivers of revenue growth were the core staples businesses, namely supermarkets and drugstores, which collectively accounted for over 70% of revenues.

Gross profit rose by 7.8% to Php45.6 billion in 2023, outpacing

revenue growth. This was propelled by assortment shifts and the

sustained penetration of private label brands. Operating income

also experienced moderate growth, rising by 2.8% year-on-year to

Php8.9 billion.

Net income attributable to equity holders of the parent company

however decreased from Php5.8 billion in 2022 to Php4.1 billion

in 2023. The decline was due to the reversal of foreign exchange

gains in 2022 to a loss in 2023 due to the appreciation of the

peso against the US dollar, the derecognition of Robinsons

Bank’s net income under equitized earnings following its merger

with BPI, and losses from start-up investments. Meanwhile, core

net earnings, which exclude foreign exchange gains/losses,

interest income from bonds, equity in earnings from associates,

interest expense related to the BPI shares acquisition

financing, BPI cash dividends, and other one-time or

non-operating items, exhibited marginal growth of 1.5% to Php5.6

billion.

Throughout the year, Robinsons Retail expanded its footprint by

adding 84 new stores, predominantly in the Supermarket and

Drugstore segments. This brought the total number of stores to

2,393, comprising 349 supermarkets, 1,054 drugstores, 50

department stores, 230 DIY stores, 408 convenience stores, and

302 specialty stores. Additionally, the company operates 2,127

franchised stores of TGP. The assortment of specialty stores

includes 119 appliances & electronics stores, 42 toys

stores, 118 mass merchandise stores, 11 beauty stores, 10 pet

stores, and 2 lifestyle sneakers stores.

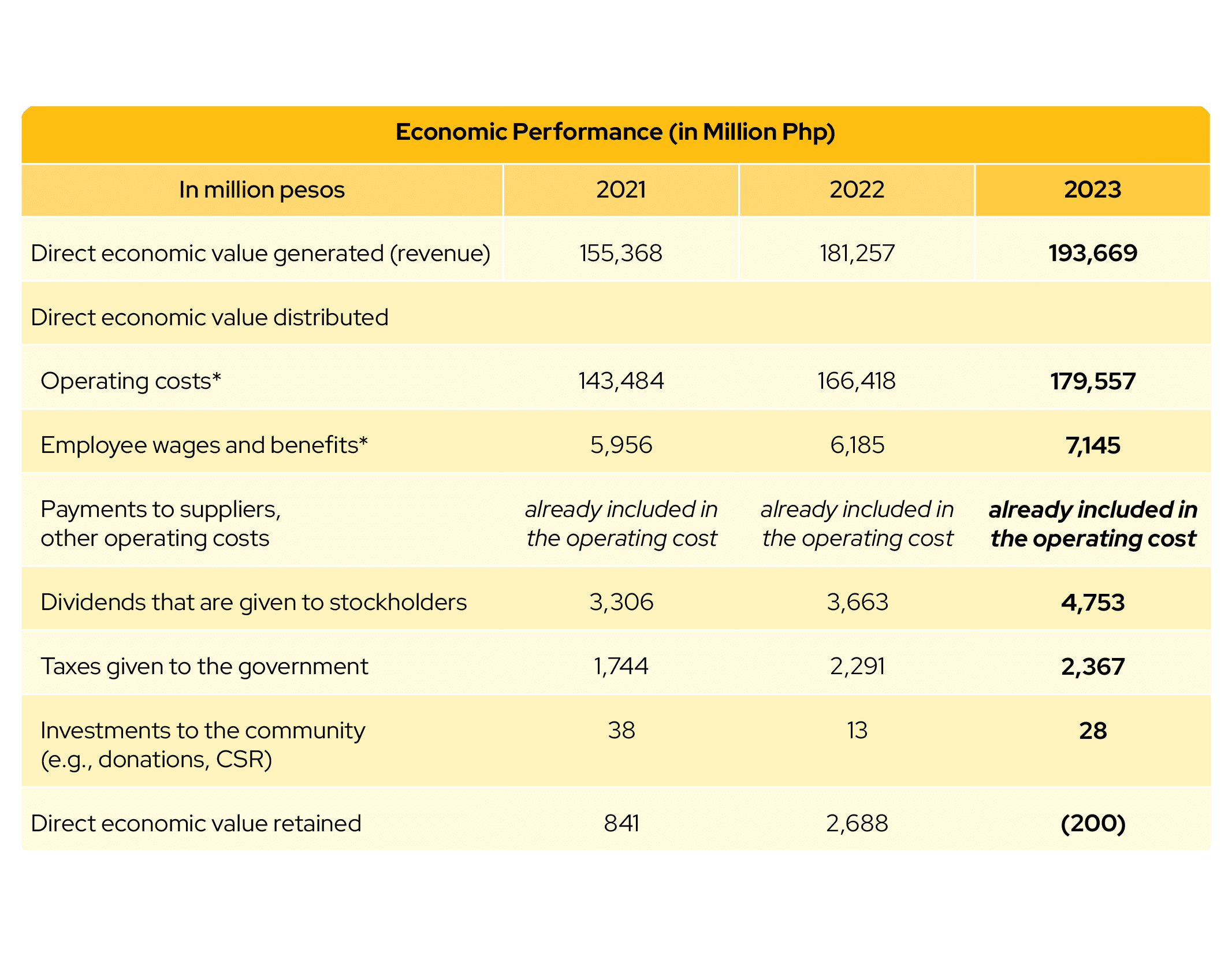

Contributing to Shared Growth:

Direct Economic Value Generated and Distributed

* Restated 2021 and 2022 values due to the original inclusion of third-party manpower wages in the employee wages and benefits.

At Robinsons Retail, we aim to create long-term value and shared

successes within the communities we operate in. Through our

operations and supply chain, we are able to impact local

economies by generating employment and nurturing a robust

network of partners and suppliers from various entrepreneurial

backgrounds.

To ensure a healthy financial standing and sustained resilience,

we maintain rigorous business continuity plans to protect our

assets and have a dedicated Enterprise Risk Management Team,

overseen by our Board of Directors.

We continue to implement our Share Buy Back Program worth Php7.0

billion to increase shareholder value and optimize returns for

our investors. Our annual cash dividend of Php 2.00 per share in

2023 equates to a payout ratio of 50%, above our 40% dividend

policy.

Looking forward, we are focused on expanding our presence in

underserved areas, strengthening our omnichannel strategy, and

pursuing strategic acquisitions to drive growth. Additionally,

we are committed to operational efficiency, sustainability, and

data-driven decision-making, ensuring that we continue to

deliver value to all stakeholders while navigating the evolving

business landscape with resilience and foresight.

Thriving in Tandem

On January 1, 2024, the merger between BPI and Robinsons Bank

was finalized, with BPI emerging as the surviving entity.

Robinsons Retail now effectively owns 6.5% of BPI and is

entitled to a board seat in the bank.

Robinsons Bank has played a pivotal role in helping our key

suppliers grow through the financial products and services that

it has offered, and this is expected to grow even more with the

facilities now accessible through BPI, helping them enhance

their operational capabilities and service offerings. This

ripple effect cascades throughout our supply chain, resulting to

improved efficiency, reliability, and ultimately, enhanced

customer satisfaction.

Omnichannel is Now

Our digital investments remain vital as we continue to expand

our digital footprint to accelerate our omnichannel strategy.

We maintain a 14% stake in Growsari, a technology-driven B2B

platform serving over 1 million sari-sari stores across the

Philippines, with products sourced from Robinsons Supermarket.

Growsari’s monthly active store users continue to increase, all

serviced via 23 distribution centers.

Now with close to 3 million customers in merely 14 months since

it began commercial operations, GoTyme continues to make waves

in the digital banking space. We currently have a 20% stake the

digital bank, which now has close to 400 bank kiosks located at

our stores. We continue to be able to onboard more customers on

GoTyme, which allows them to receive a debit card within minutes

but also conveniently cash-in and cash-out for free across our

stores and earn Go Rewards points every time they use their

cards. As GoTyme continues to accelerate, has also helped

accelerate the growth of our Go Rewards customer base, which now

has more than 8 million members.

Our 23% stake in O!Save, a hard discount supermarket chain

established in 2021, also continues to yield promising results

as it continues to expand across the country. This collaboration

enables us to tap into the growing hard discount supermarket

segment, while enabling O!Save to tap into the expertise and

resources of an established retail player like us.

Finally, GoCart, our in-house e-commerce platform dedicated to

our formats, remains essential to realizing our omnichannel

push. GoCart continues to allow us to bridge the gap between our

physical stores and our online footprint, offering customers

convenience and flexibility in their shopping journey.

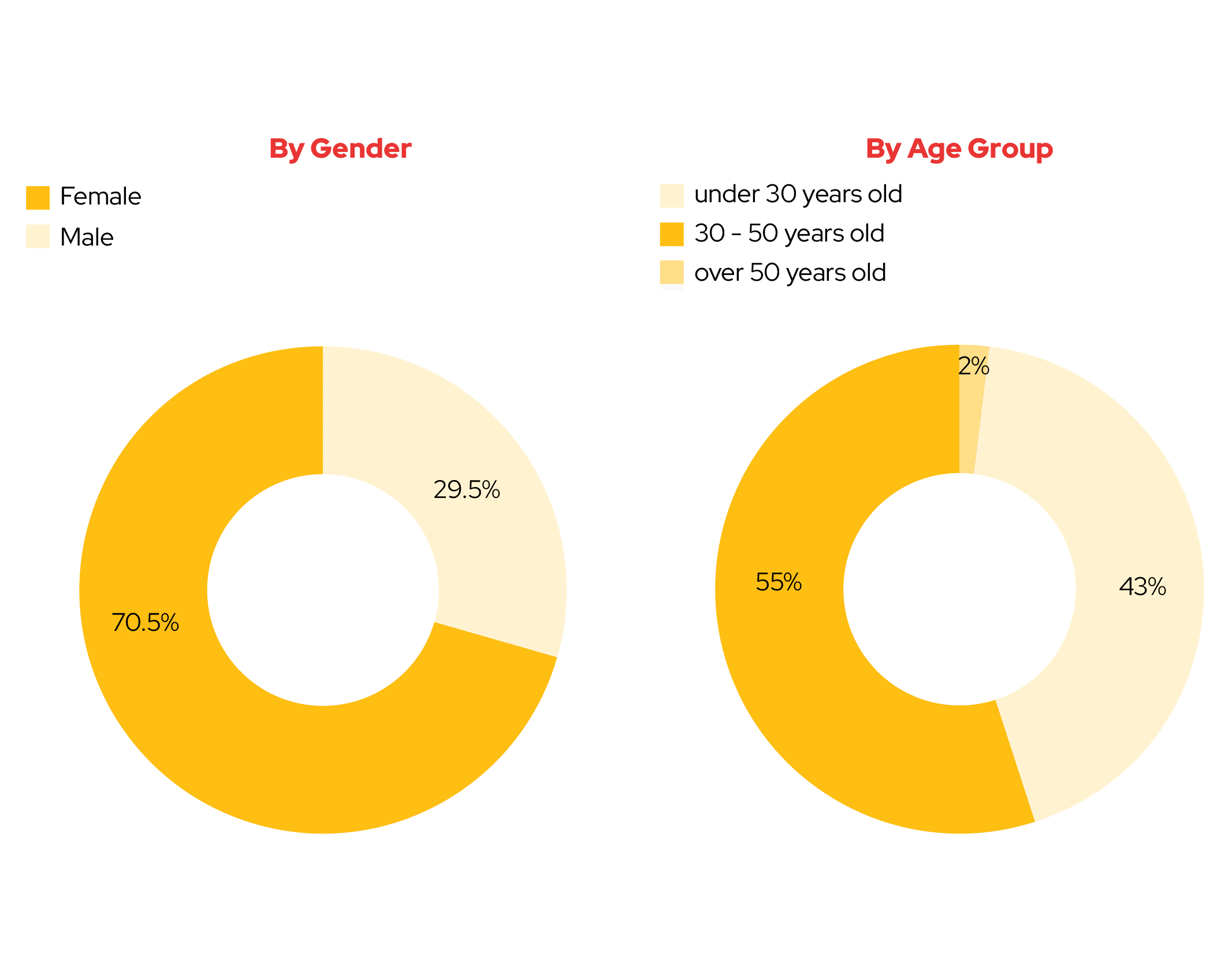

Our People

Diversity Drives Innovation

At Robinsons Retail, diversity is our strength. Each member of

our team brings a unique set of skills, perspectives, and

experiences to the table, enriching our approach to business and

driving innovation forward. We understand that fostering an

inclusive workplace is not just the right thing to do – it is

essential for our success.

Our hiring and onboarding process are designed to be objective

and non-gendered, ensuring that we attract and retain a diverse

pool of talent. We are committed to creating environments where

everyone, regardless of gender, feels valued and empowered to

contribute their best work.

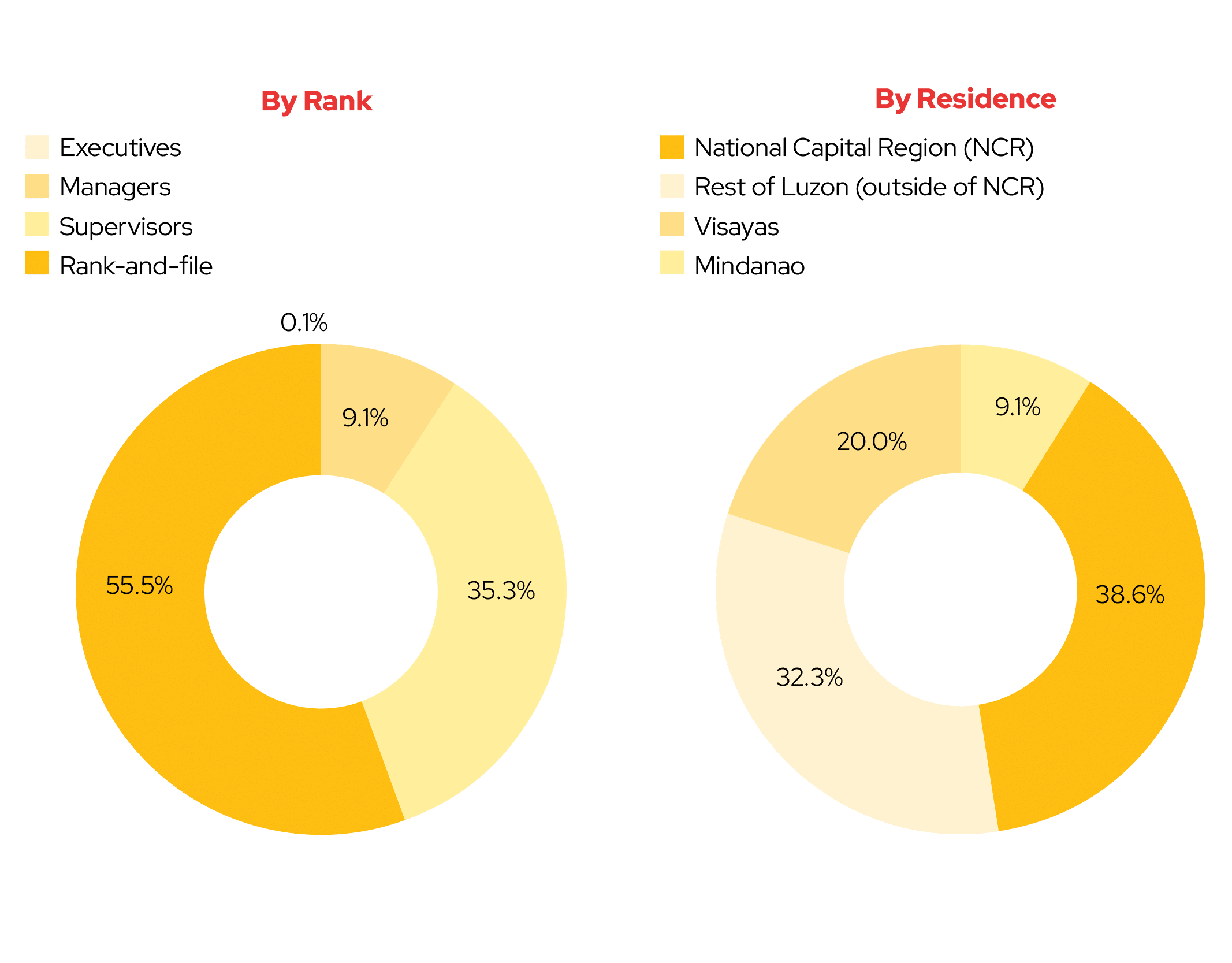

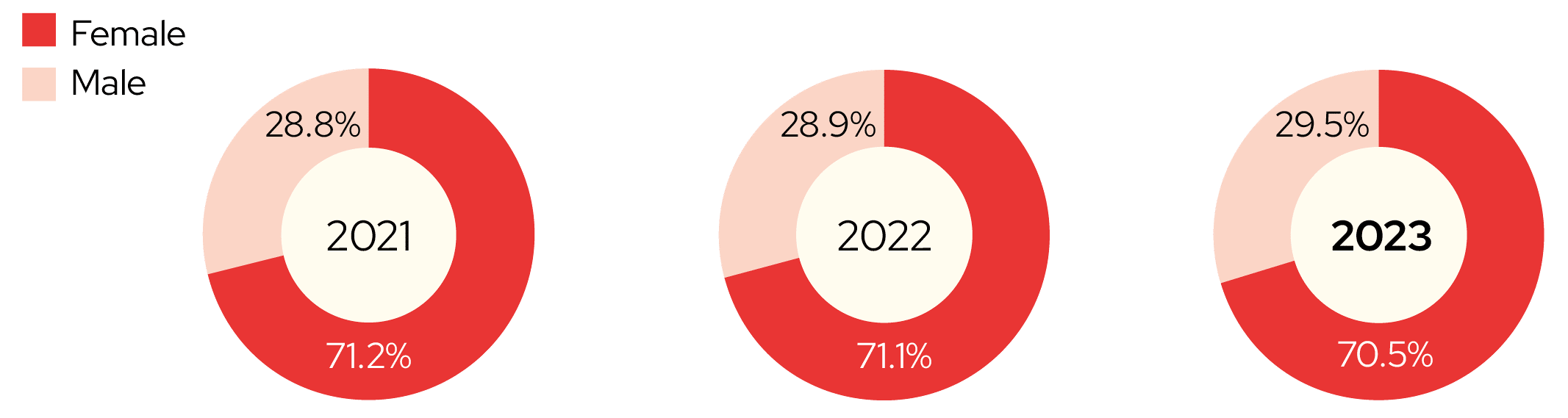

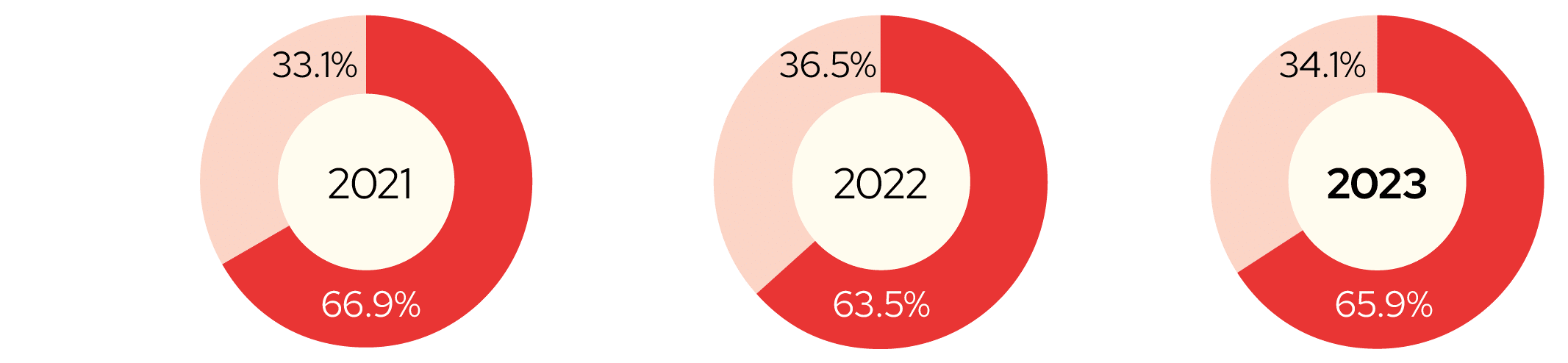

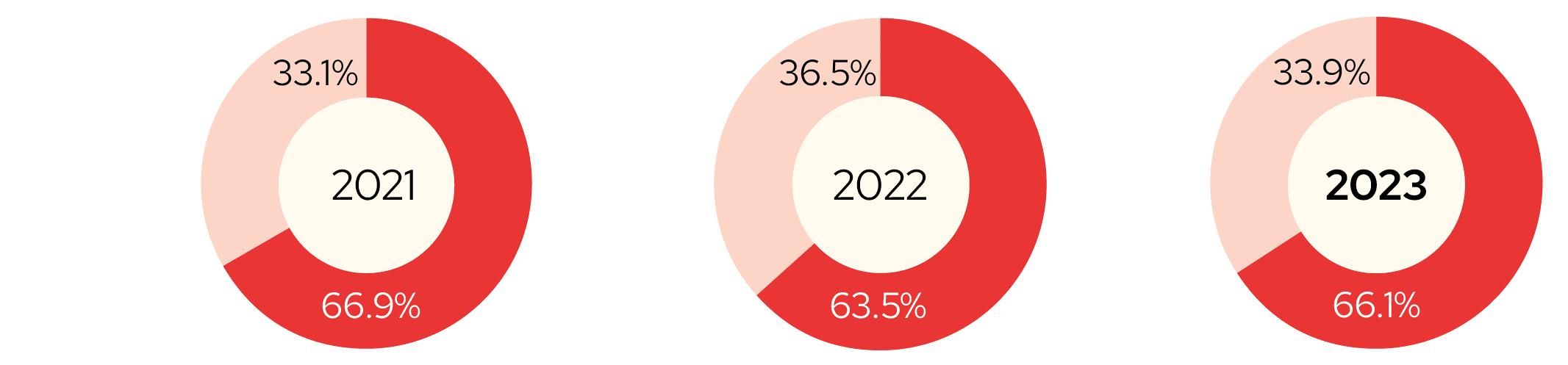

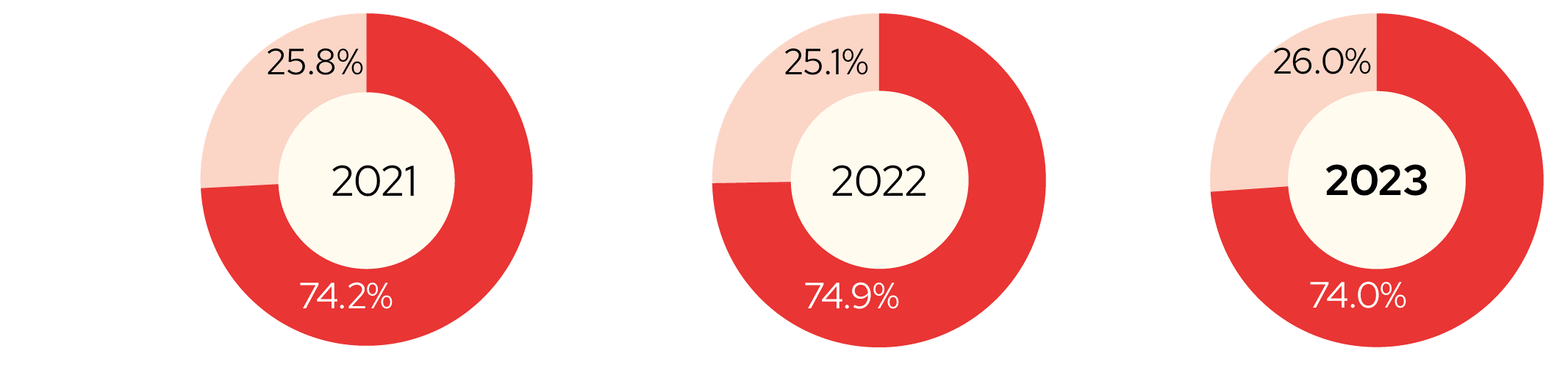

At Robinsons Retail, women are at the helm, steering our

Company’s success across all facets of management. Currently,

women comprise 70.5% of our workforce, occupying key positions,

including our President and CEO, Chief Financial and Chief Risk

Officer, Treasurer, Corporate Secretary, and Head of Corporate

Planning, Investor Relations, and Sustainability. Additionally,

65.9% and 66.1% of women employees hold managerial and

supervisory roles, respectively.

Our efforts in championing our employees resulted in our

re-inclusion in the Philippine Daily Inquirer and Statista’s

list of the Philippines’ Best Employers, together with our

subsidiaries, Robinsons Supermarket, Robinsons Appliances, Rose

Pharmacy, and South Star Drug.

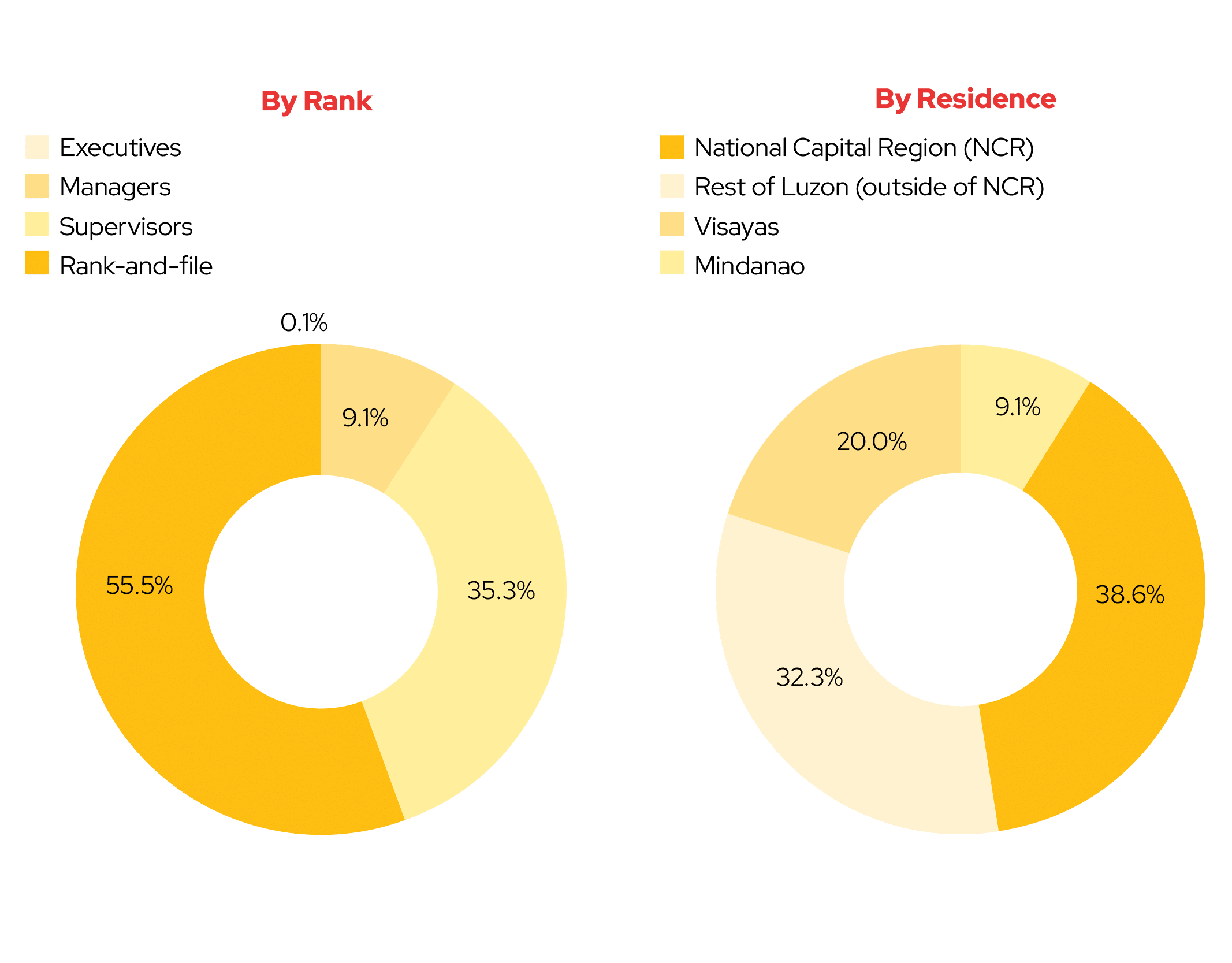

2023 Demographics

Diversity and Equal Opportunity

Employees in the Workforce

Employees in Executive-Level Positions

Employees in Managerial Roles

Employees in Supervisory Roles

Employees in Rank-and-File Positions

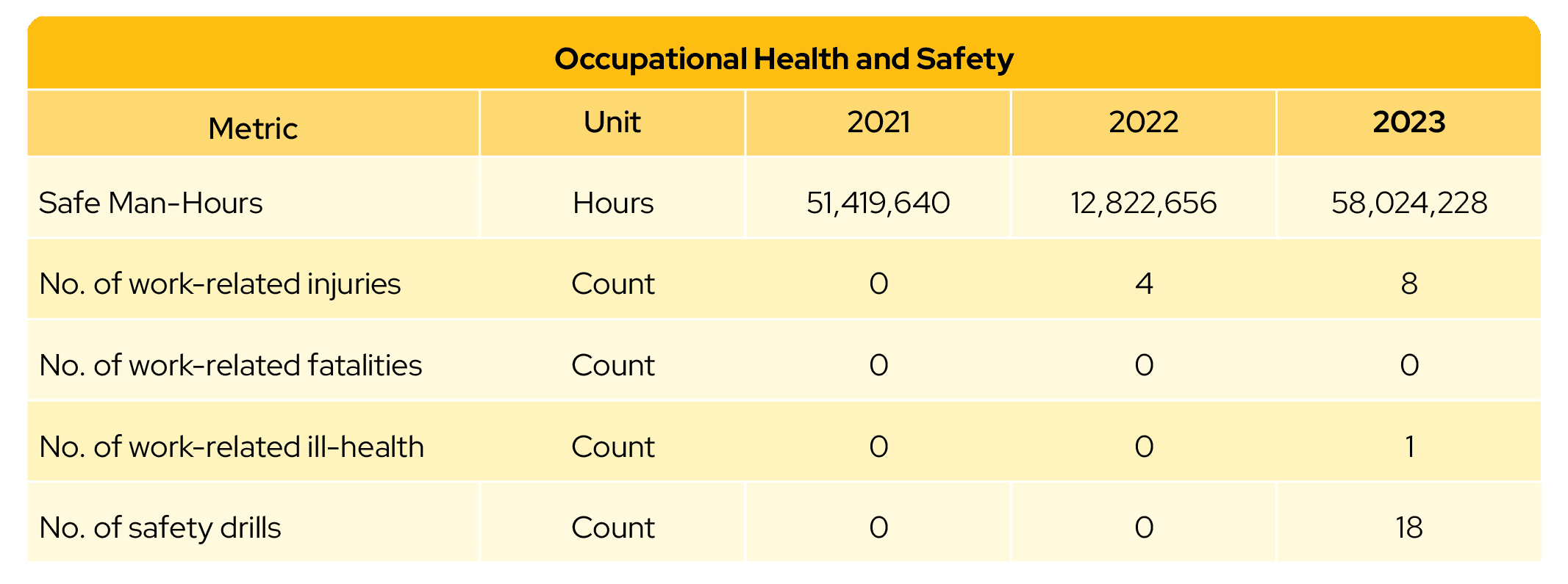

A Safe Place to Work

Ensuring the occupational health and safety of our employees is

paramount to us as it directly impacts overall well-being and

productivity. We adhere to stringent safety, health, and welfare

standards established by the Department of Labor and Employment

to guarantee safe and healthy working conditions for everyone

who interacts with our establishments.

In addition to complying with regulatory requirements, we

maintain comprehensive Security and Safety Manuals that undergo

regular review to ensure their ongoing effectiveness and

relevance. These manuals serve as vital resources for our teams,

providing clear guidance on best practices and protocols to

mitigate risks and respond effectively in emergency situations.

To further bolster our preparedness, we have established a

Corporate Emergency Response Team (CERT) entrusted with leading

crisis management initiatives across our conglomerate. The CERT

oversees the periodic review of contingency plans and emergency

preparedness procedures to uphold our commitment to effective

responses and responsible crisis management.

By prioritizing occupational health and safety and maintaining

robust emergency response mechanisms, we strive to create a

secure and resilient environment for our employees, customers,

and stakeholders alike.

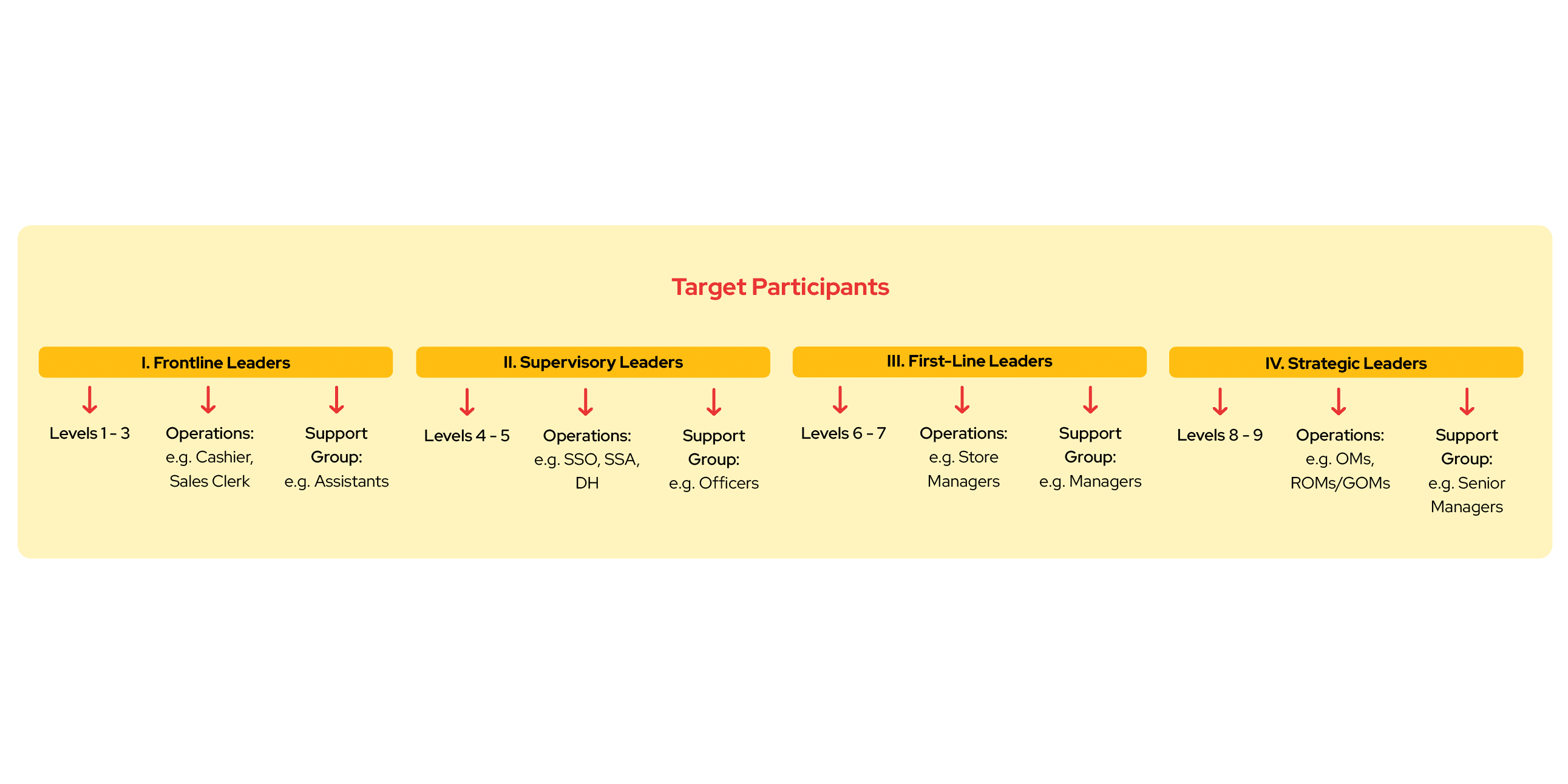

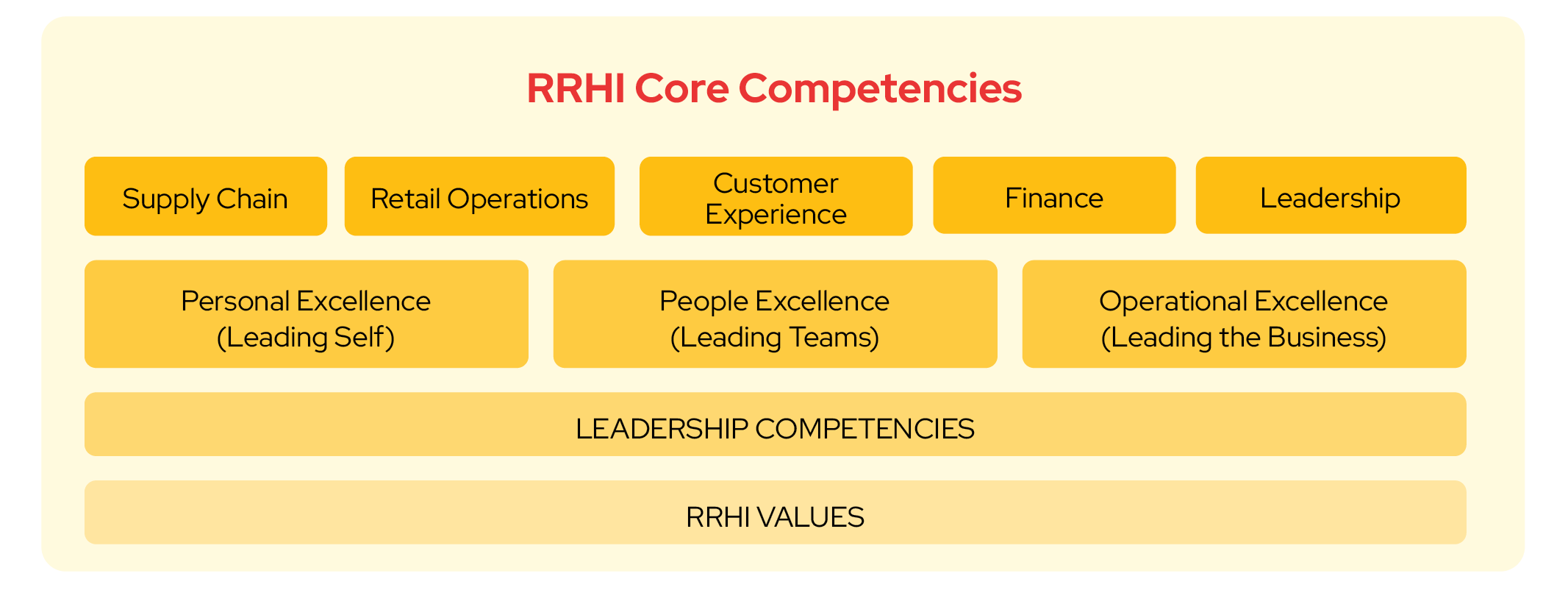

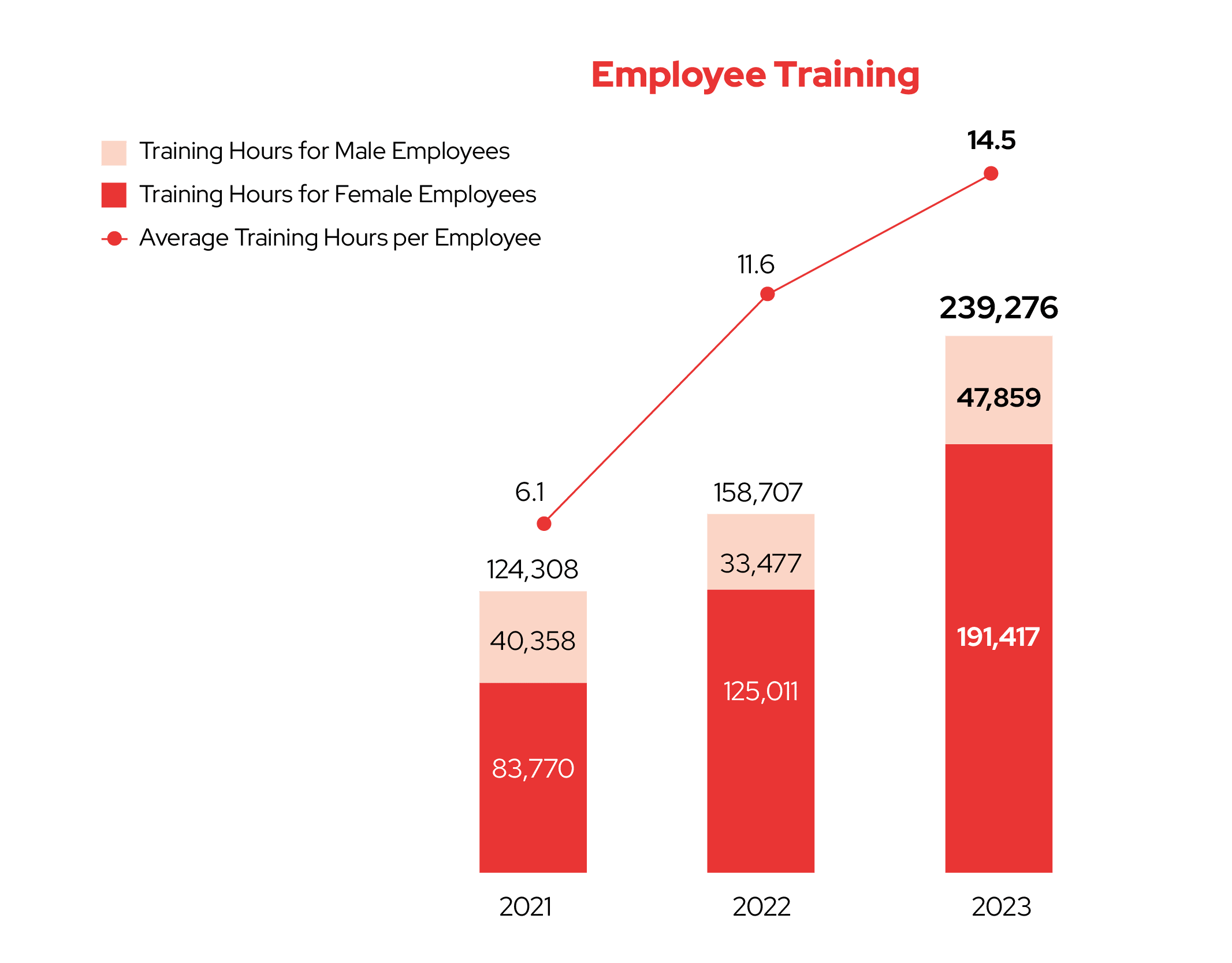

Robinsons Retail Academy

We believe in investing in our people, empowering them to reach their full potential and thrive in their roles. Through comprehensive training programs, personalized development plans, and continuous learning opportunities, we equip our employees with the skills and knowledge they need to excel.

Robinsons Retail Academy Curricula

New Employee Orientation

An employee orientation program for new RRHI employees

Digital Learning Program

A set of bi-weekly programs focusing on essential skills, knowledge and mindest: the courses focus on Personal Excellence, People Excellence and Operational Excellence.

Retail Excellence Curriculum

A set of learning roadmaps per level for all regular employees focusing on building retail-based leadership and maangement competencies.

Management Development Curriculum

A set of learning roadmaps for key talents focusing on developing them for their current and future roles aligned to both functional and leadership management competencies

Thematic Programs

A pool of capability building programs supporting the organization’s goals and strategies (e.g. Supply Chain, Customer Experience)

The Robinsons Retail Academy (RRA) is a flagship initiative

crafted by our Learning & Organizational Development

(L&OD) team to provide learning opportunities to its

employees. RRA is a beacon of structured employee development,

offering a comprehensive array of learning opportunities

tailored to enhance skills, deepen knowledge, and cultivate

expertise across the Company.

With a focus on aligning training initiatives with our business

objectives, RRA serves as a centralized hub for all things

learning. The RRA provides a unified platform streaming access

to a diverse range of courses, workshops, and seminars.

Sustainability 101

As part of our New Employment Orientation program, new employees

also receive a comprehensive overview of sustainability within

the context of the Company’s operations against the broader

global landscape. Robinsons Retail’s Sustainability Manager

provides an overview of our sustainability initiatives,

emphasizing our responsibility to minimize our environmental

impact, support local communities, and promote ethical practices

throughout our supply chain.

Through real-world examples and interactive discussions,

employees uncover the tangible ways they can contribute to our

sustainability efforts, both within and outside the workplace

fostering a sense of stewardship from day one. We empower our

new hires to become champions of sustainability within Robinsons

Retail and beyond.

Nurturing Partnerships for Shared Value

Our suppliers and trade partners are integral to our creation of

shared value as well as supporting the livelihood of various

businesses and providing access to goods for our end-consumers.

Currently, over 90% of our vendors are Philippine-based

manufacturers and distributors, including those that source

products abroad and serve as the official distributors of

foreign brands.

To reinforce our commitment to nurturing better relationships

with these essential partners, we continue to work towards

improving forecasting demand to maintain just-in-time inventory

deliveries to increase supply efficiency allowing us to reduce

shrinkage or wastage. Through the cross-docking systems at our

distribution centers, we are also able to speed up the delivery

of products and reduce the unnecessary maintenance of stocks.

To thank our partners for a successful 2023, we held our annual

Trade Partners Nights highlighting the vital contributions of

our partners as we continue to create value, drive excellence,

and deliver unparalleled service to the customers and

communities we serve.

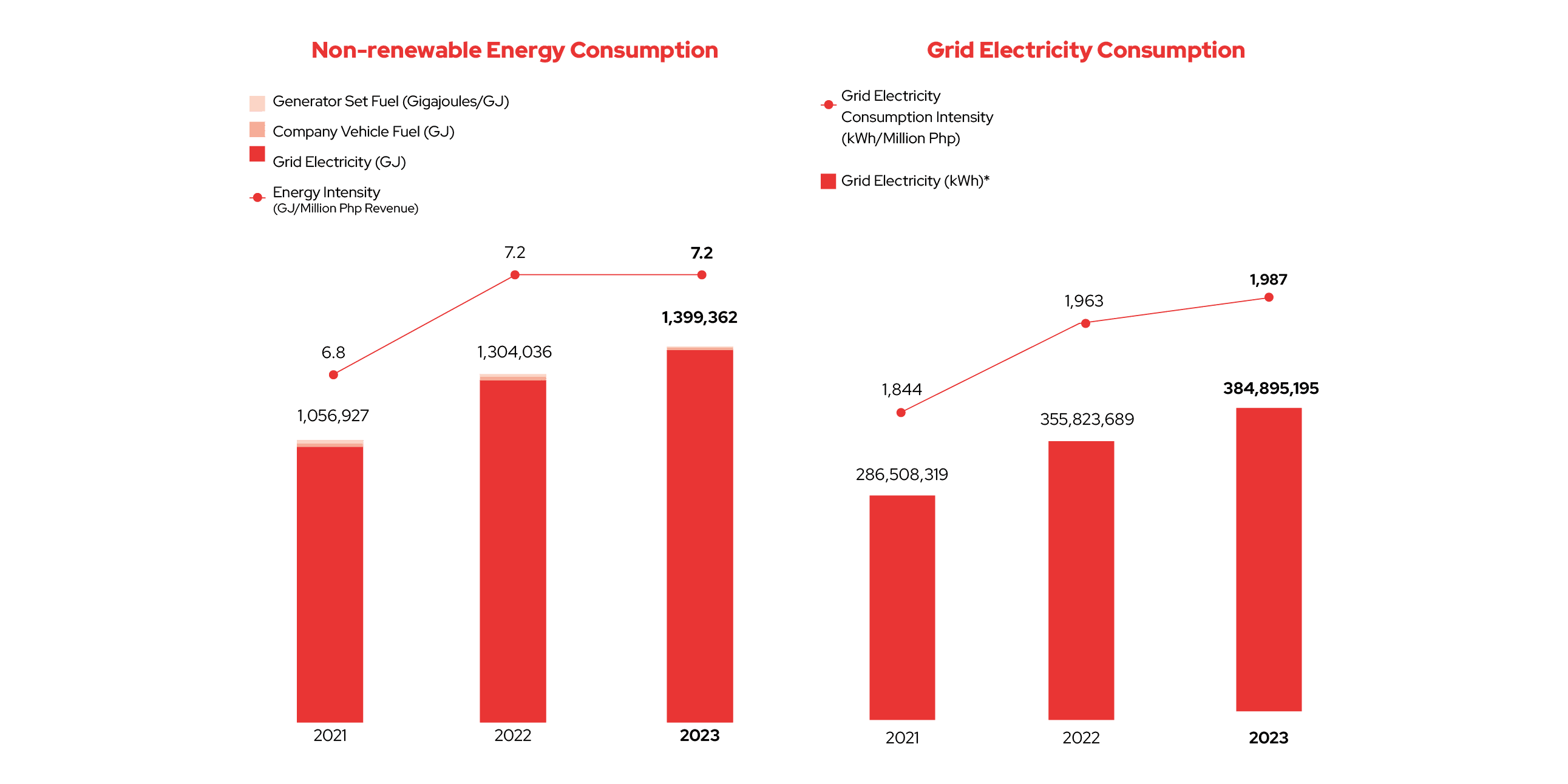

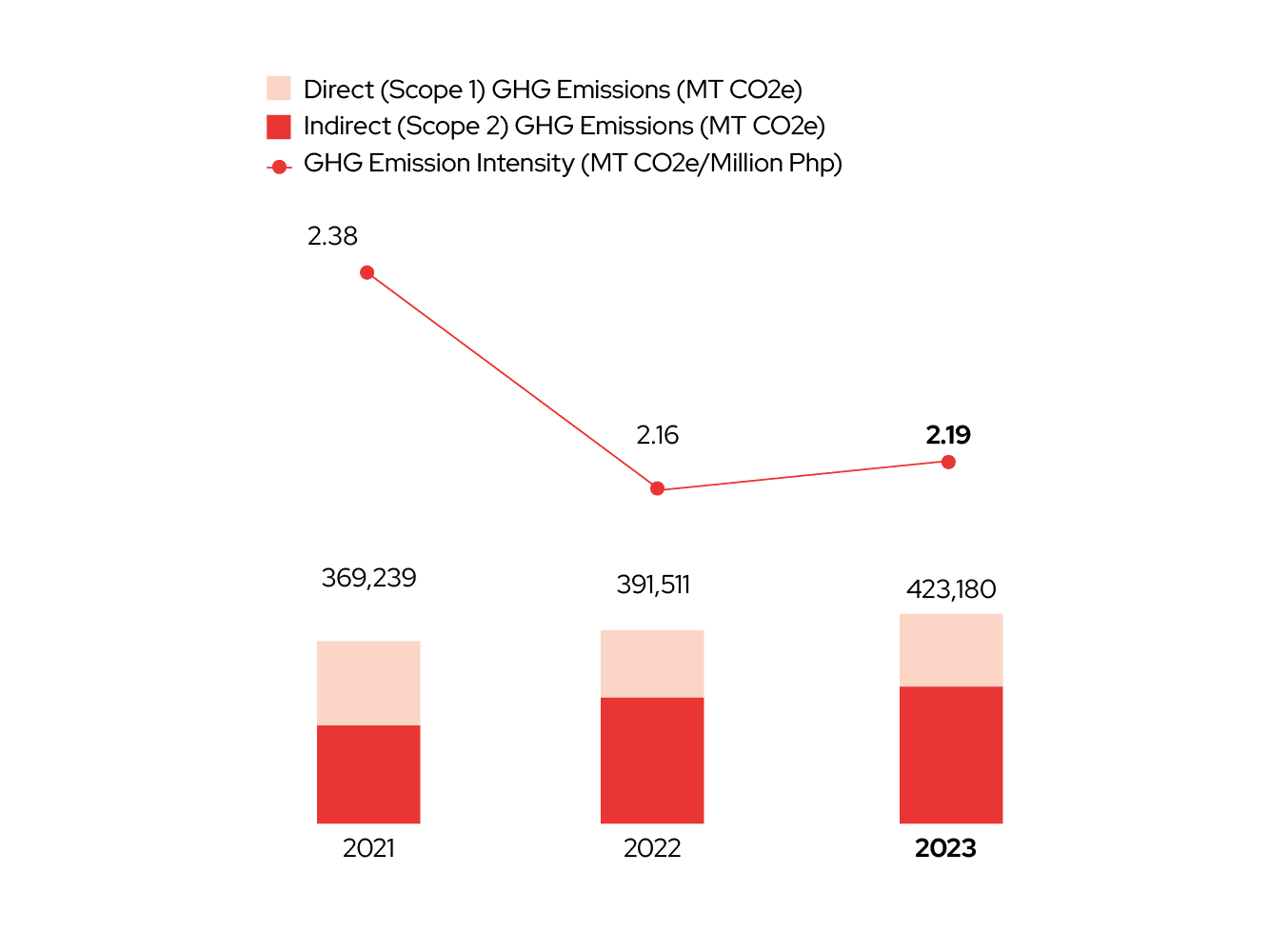

Energy Management and Climate Action

As our store and office operations rely heavily on electricity and fuel, we remain steadfast in our commitment to reducing our carbon footprint. We continue to convert our refrigeration and air-conditioning systems using lower-impact refrigerants and explore energy-efficient technologies. We will start to conduct more rigorous energy and emission reduction studies and explore renewable power purchase partnerships, prioritizing facilities with higher energy consumptions in order to eventually reduce our energy and emission intensity as we continuously expand our store network.

* Restated 2021 and 2022 values due to the original inclusion of third-party manpower wages in the employee wages and benefits.

GHG Emissions (Scope 1 and 2)

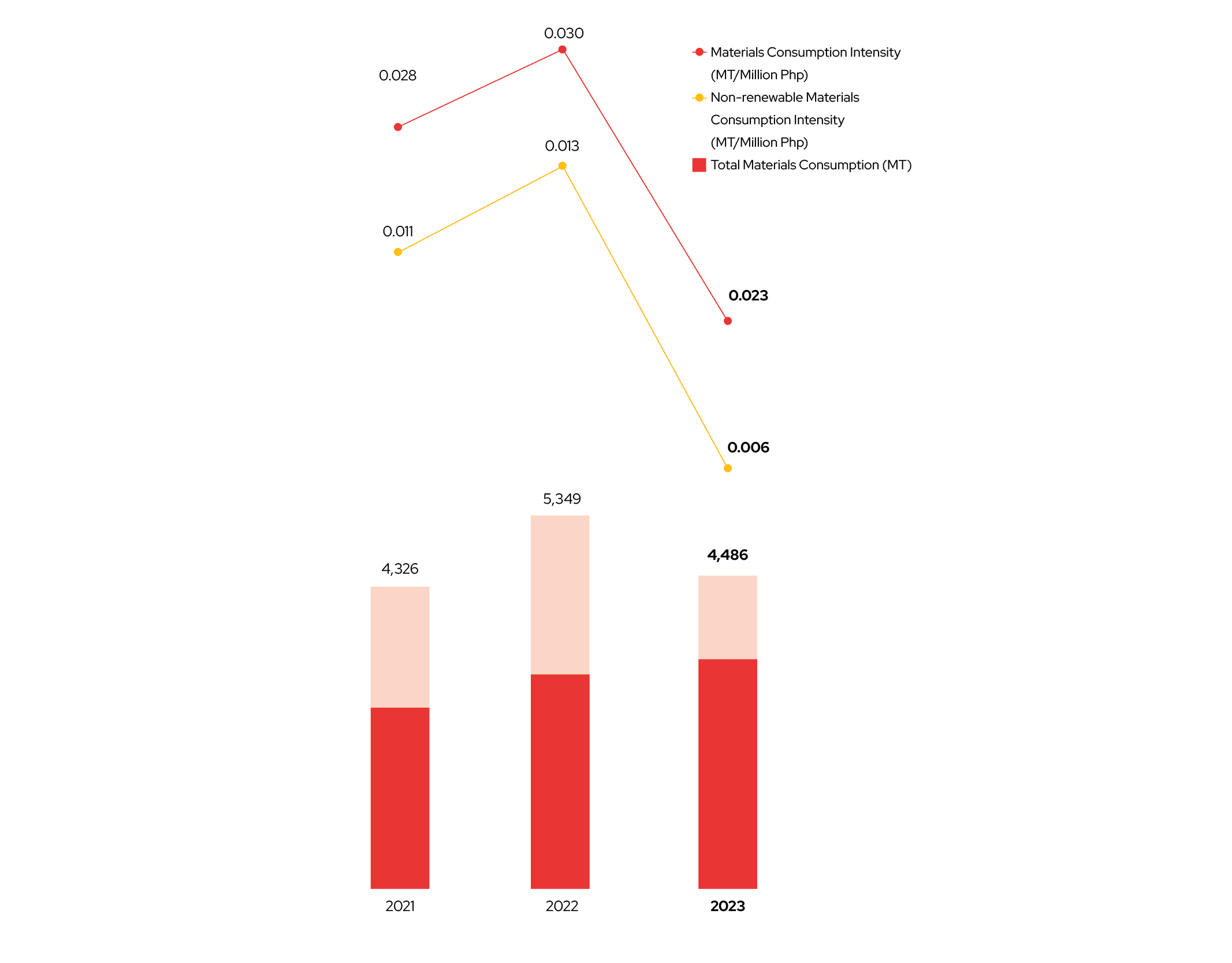

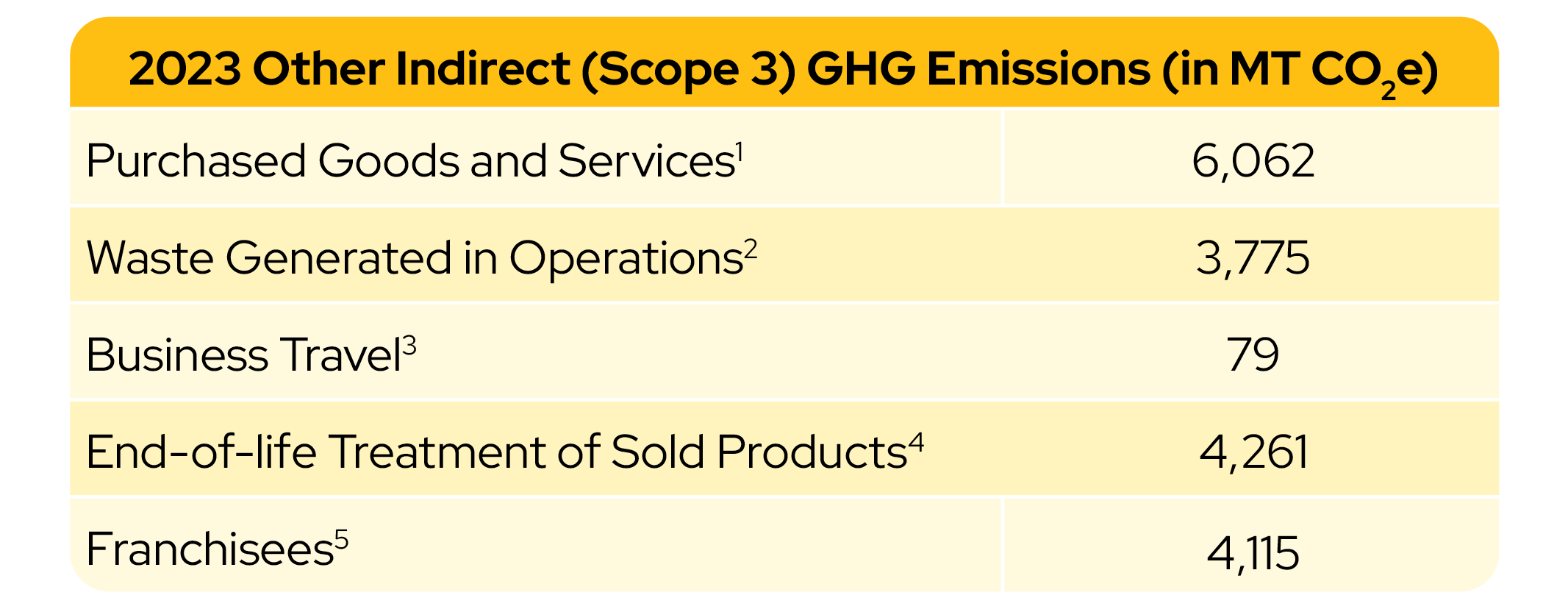

1 Based on renewable materials (paper bags) and non-renewable

materials (plastic bags) consumption

2 Based on solid waste generation

3 Based on fuel consumption of rented vehicles

4 Based on plastic footprint of sold house brands

5 Based on electricity consumption of Uncle John's franchised

stores

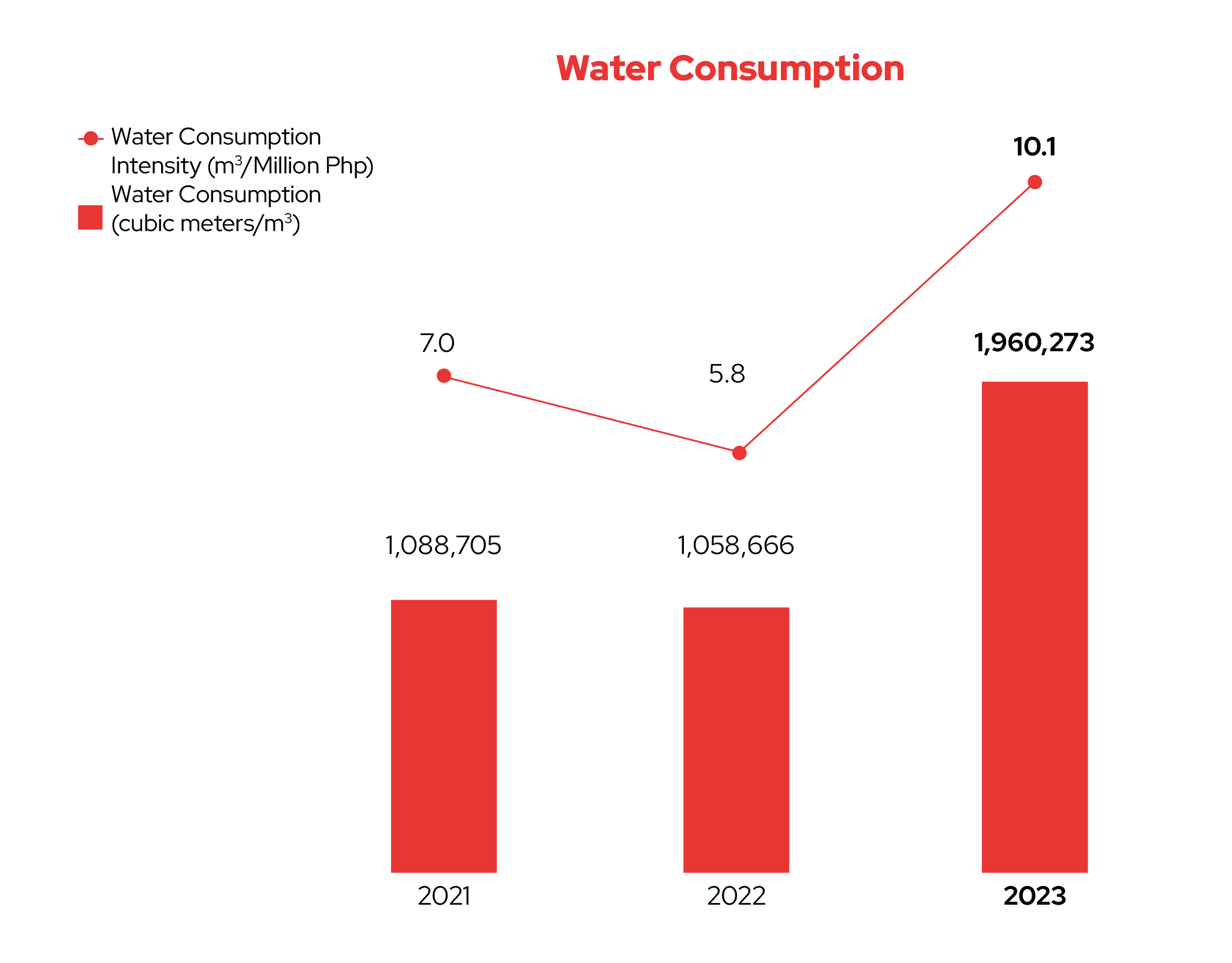

Water Management

While our operations may not demand extensive water usage

compared to certain industries, we uphold a vigilant stance on

monitoring our water consumption. Sourcing water from

local-third party lines, we prioritize efficient and responsible

usage practices across our offices and stores.

Our water use mainly stems from office and store lavatory

facilities and routine maintenance and cleanliness protocols. To

mitigate waste and conserve water, we implement regular

monitoring of our plumbing and water systems. By proactively

identifying and rectifying issues such as leakages, we minimize

the risk of significant water loss and ensure sustainable

management of this essential resource. The increase in 2023

water consumption is a result of the data gathering improvements

from our stores and warehouses.

Climate Resilience Project

Our Journey towards Climate Action

As a business, we continue to do our part for climate action.

This journey began in 2019 with the publishing of our inaugural

stand-alone Sustainability Report.

In 2021, we embedded sustainability and climate risk

considerations into our ERM framework. We also embedded

Sustainability into our Corporate Governance committee as we

intend to drive more sustainability and climate agenda in

board-level discussions. Aspiring to set our climate and

sustainability targets in the coming years, we recognized the

importance of a credible baseline data for target setting. Thus,

we engaged an independent consultant for our first ESG external

assurance covering 2022 disclosures, whereby reporting

improvements were recommended for energy and climate

disclosures. We also recalibrated our sustainability framework,

simplifying them to cover 4 focus areas reflecting the material

topics that our retail business must tackle at scale.

Continuing our momentum, we initiated our climate resilience

journey as we aim to solidify our climate mitigation and

adaptation targets and roadmap. This involved assessing our

exposure to physical climate hazards and conducting

vulnerability assessment of selected business-critical pilot

facility to develop tailored adaptation strategies. These

proactive steps position us to adhere to anticipated updates to

sustainability reporting guidelines, such as the SEC SR

Guidelines and the launch of the IFRS Sustainability Disclosure

Standards. We also started to initially map out and partially

disclose our other indirect GHG emissions across our value chain

(Scope 3 GHG emissions) as we commit to involve our stakeholders

across our value chain to participate in climate action. These

milestones lay the groundwork for a strategic shift towards a

more sustainable and climate-resilient future, setting the tone

for years to come.

Our Approach and Strategy in Climate Resilience

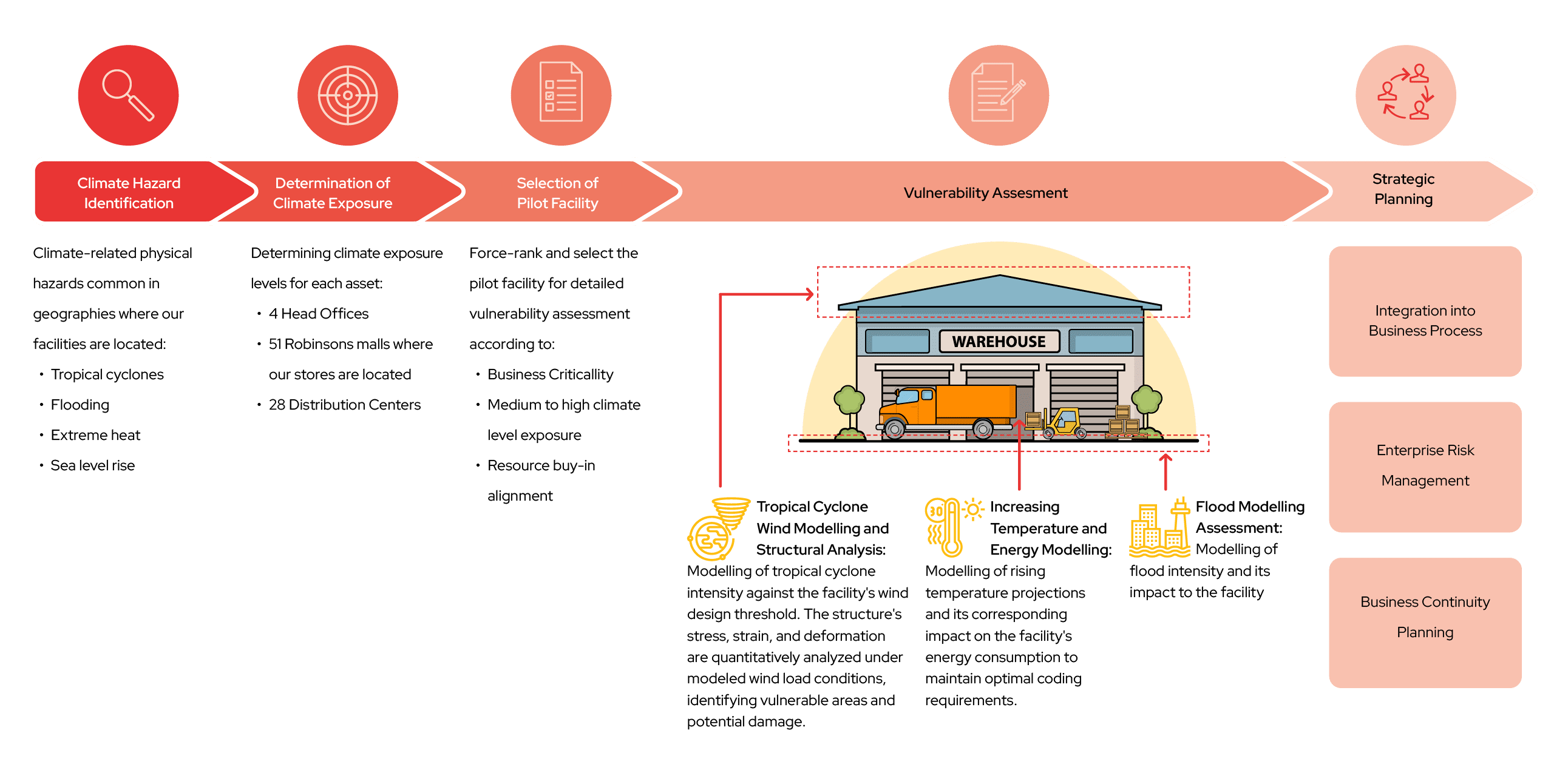

Situated in an archipelagic region prone to tropical cyclones, our businesses face such inherent climate hazards. Intense tropical cyclones, flooding, and rising temperatures could adversely impact our assets, operations, and workforce. As a foundational step in our climate strategy, we have identified and assessed climate-related physical risks and opportunities at a facility-level, alongside their operational and business impacts. We have evaluated our climate resilience in coping with the various climate scenarios. This process allowed us to gauge the inherent resilience of our assets and develop tailored risk mitigation strategies to enhance operational efficiency and business continuity. This targeted analysis represents the first phase of a broader strategy that we plan to be replicated across our portfolio of critical operational assets. We are integrating this climate resilience assessment into our business processes, utilizing them to refine strategic planning, and strengthen our Enterprise Risk Management and Business Continuity Planning. This ensures our approach to managing climate risks is robust and actionable at the operating unit level.

Overview of Our Climate Resilience Assessment Process

a. Climate Scenarios

Understanding climate information is crucial for assessing

the impact of both physical and transition risks across

various future scenarios and making informed decisions for

adaptation and mitigation strategies. This is critical as it

allows us to assess potential future impacts of both

physical hazards and the transition to a low-carbon economy.

By considering various climate futures, we can make informed

decisions on adaptation strategies to strengthen our

operations and mitigation efforts to reduce our

environmental footprint, ensuring long-term business

resilience.

IPCC's Representative Concentration Pathways (RCP) 8.5 and

4.5 was selected for our analysis. RCP 8.5 represents a high

emission scenario, indicating a future where greenhouse gas

emissions continue to rise rapidly leading results in

greater impacts from physical hazards such as higher global

temperature increase, intense extreme weather events and

faster sea-level rise as a consequence of inaction on

climate change. Conversely, RCP 4.5 represents a scenario

where emissions peak around mid-century before declining. By

considering both pathways, we encompass a broad spectrum of

potential future emissions trajectories for climate-related

physical risks.

Our definitions of short-term (1-5 years), medium-term (6-15

years), and long-term (16 years and beyond) closely mirror

the general timeframes used in our strategic

decision-making. The 2030-2060 timeframe, which falls under

medium-term to long-term, was chosen to match the projected

timelines of climate models and the operational lifespan of

assets, ensuring the assessments remain relevant.

Additionally, in 2025, we plan to evaluate the impacts of

the low-carbon transition and climate-related transition

risks and opportunities on our business under the RCP 2.6

scenario.

Understanding climate information is crucial for assessing

the impact of both physical and transition risks across

various future scenarios and making informed decisions for

adaptation and mitigation strategies. This is critical as it

allows us to assess potential future impacts of both

physical hazards and the transition to a low-carbon economy.

By considering various climate futures, we can make informed

decisions on adaptation strategies to strengthen our

operations and mitigation efforts to reduce our

environmental footprint, ensuring long-term business

resilience.

IPCC's Representative Concentration Pathways (RCP) 8.5 and 4.5

was selected for our analysis. RCP 8.5 represents a high

emission scenario, indicating a future where greenhouse gas

emissions continue to rise rapidly leading results in greater

impacts from physical hazards such as higher global temperature

increase, intense extreme weather events and faster sea-level

rise as a consequence of inaction on climate change. Conversely,

RCP 4.5 represents a scenario where emissions peak around

mid-century before declining. By considering both pathways, we

encompass a broad spectrum of potential future emissions

trajectories for climate-related physical risks.

Our definitions of short-term (1-5 years), medium-term (6-15

years), and long-term (16 years and beyond) closely mirror the

general timeframes used in our strategic decision-making. The

2030-2060 timeframe, which falls under medium-term to long-term,

was chosen to match the projected timelines of climate models

and the operational lifespan of assets, ensuring the assessments

remain relevant. Additionally, in 2025, we plan to evaluate the

impacts of the low-carbon transition and climate-related

transition risks and opportunities on our business under the RCP

2.6 scenario.

b. Climate Models and Tools

Our physical climate-risk modeling incorporates the current

advancements in climate science from peer-reviewed scientific

studies and is subject to refinement as our understanding of

climate science evolves. For temperature projections, we rely

on the high-resolution data from the Coordinated Regional

Climate Downscaling Experiment for Southeast Asia

(CORDEX-SEA), ensuring detailed spatial and temporal analysis.

The assessment of future tropical cyclone frequency and

intensity utilizes data from the IPCC's Coupled Model

Intercomparison Project Phase 6 (CMIP6), which incorporates

atmospheric, oceanic, land surface, and sea parameters.

Additionally, our flood modeling is conducted using

hydrological analysis with Hydrologic Engineering Center –

Hydrologic Modelling System (HEC-HMS) to generate hydrographs

and flood maps, incorporating projected rainfall data from

PAG-ASA's Climate Information and Risk Analysis Matrix

(CLIRAM), ensuring our models are both current and with high

spatial and temporal resolution to capture the specific

climatic feature of the region.

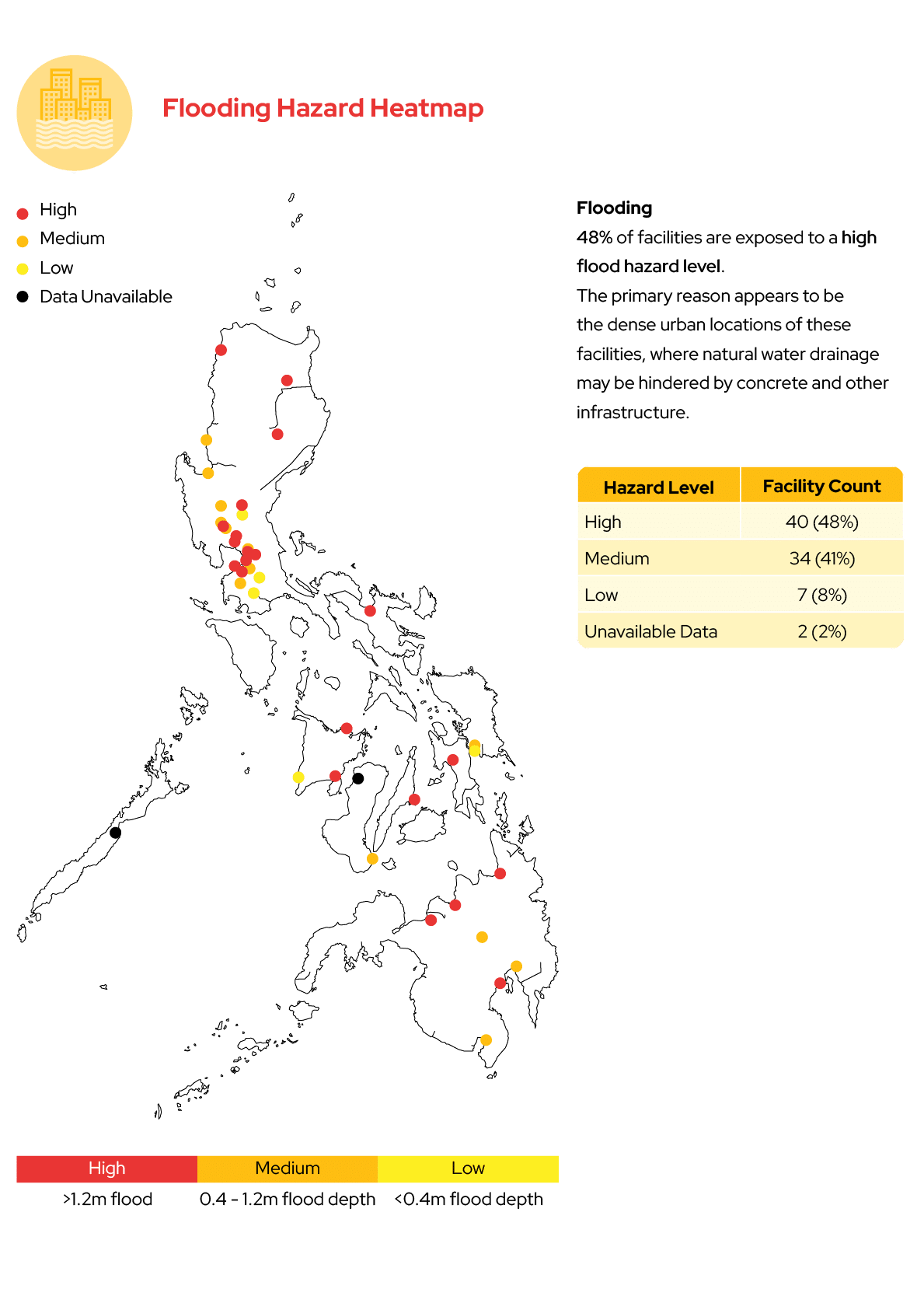

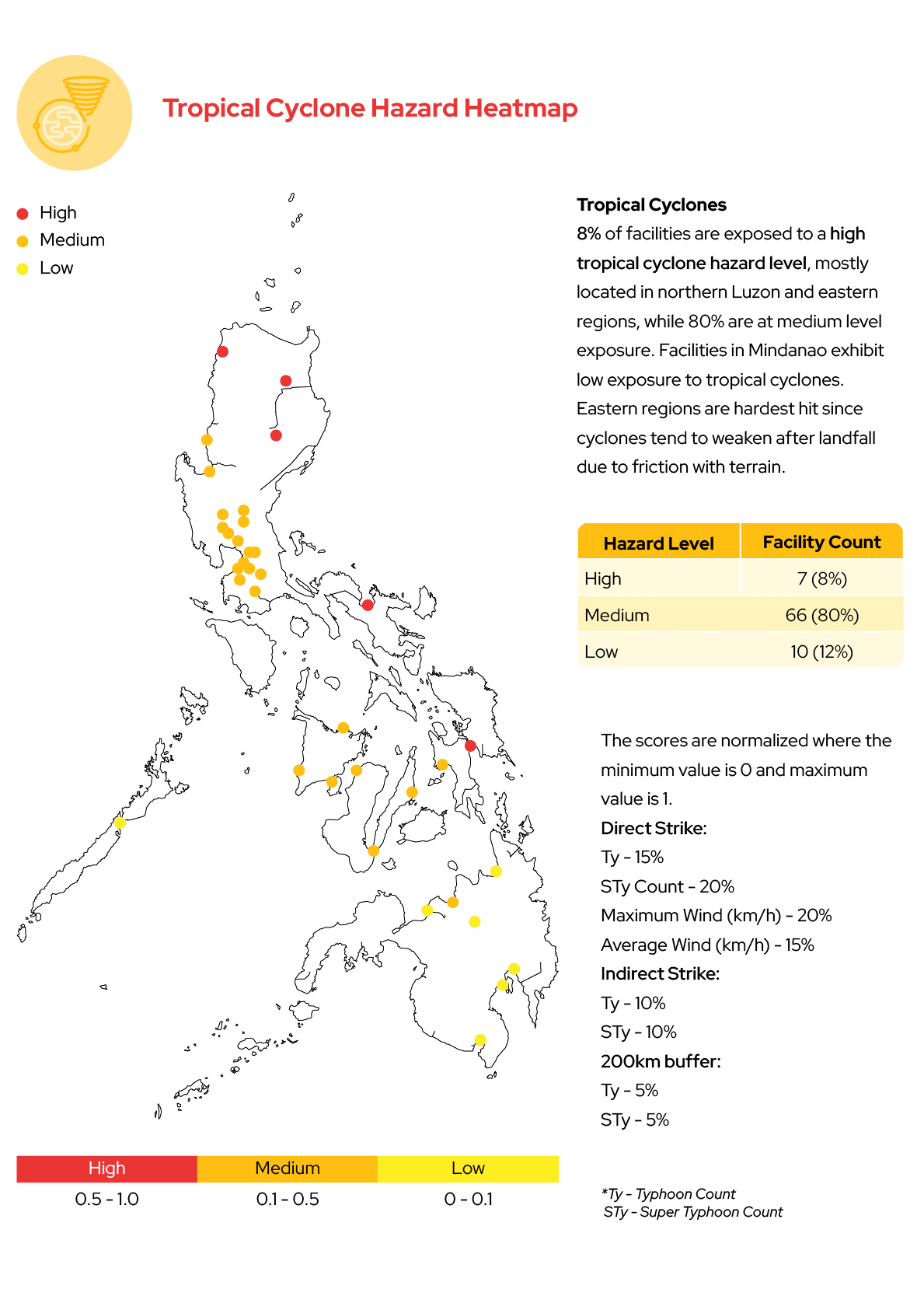

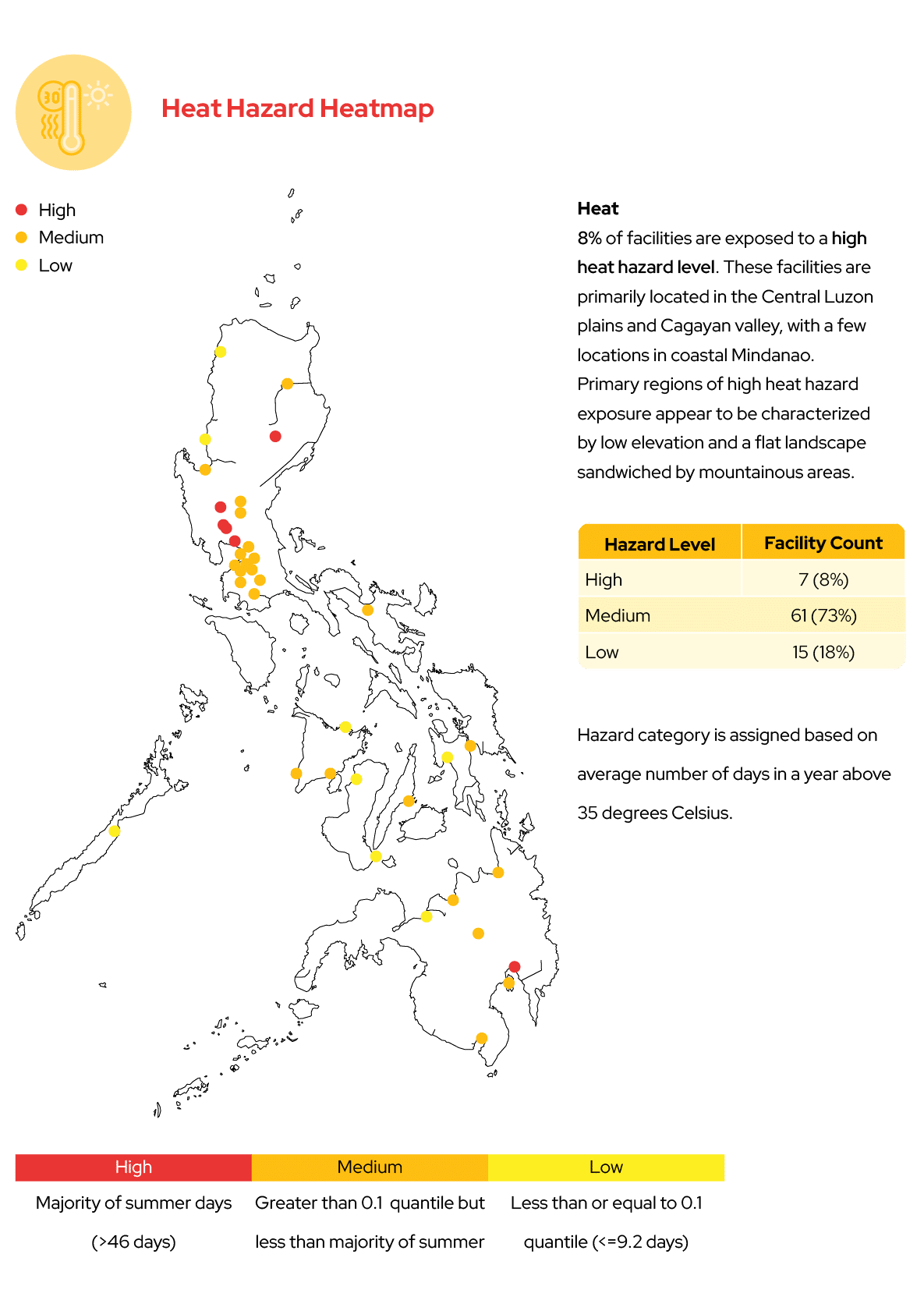

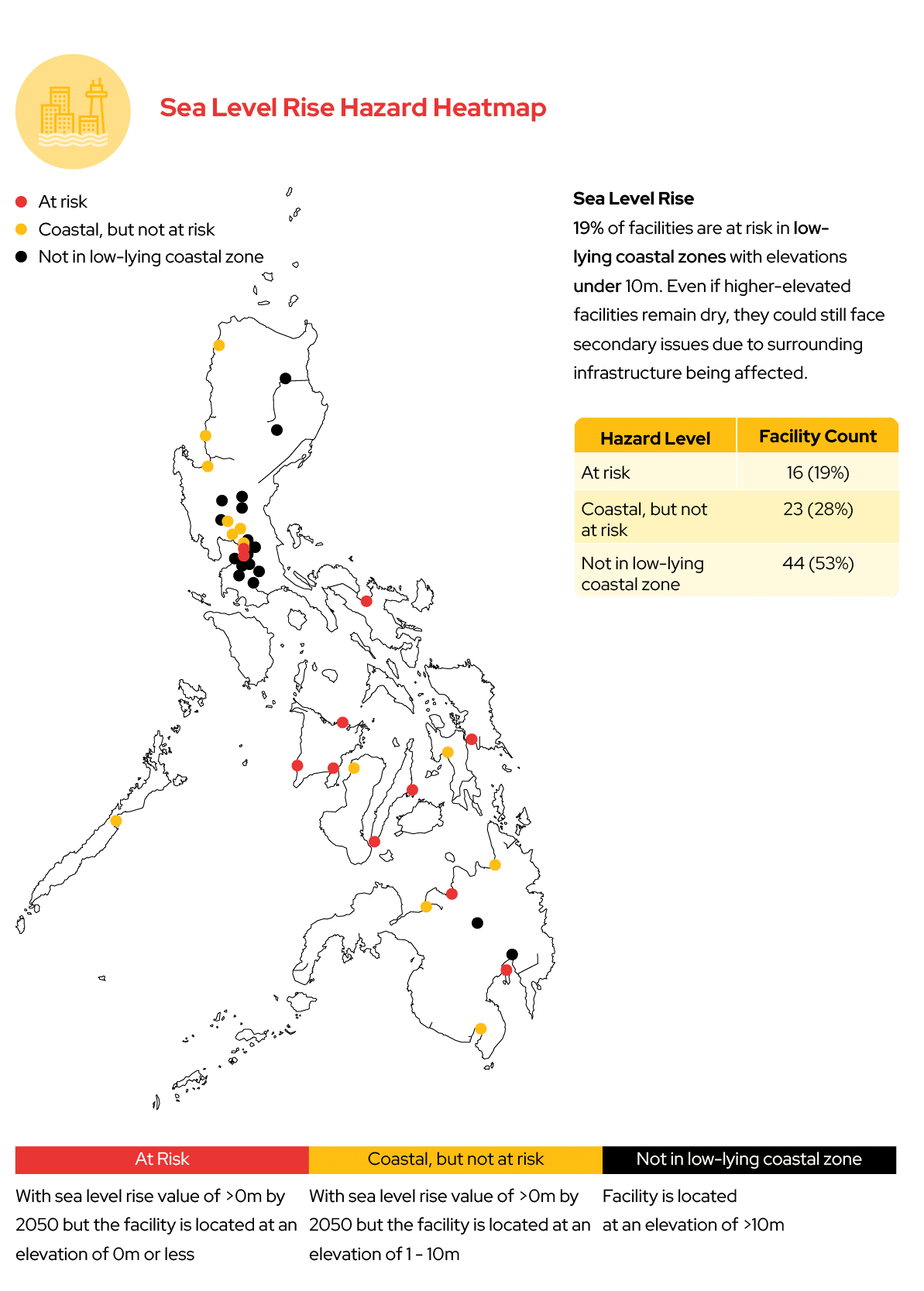

c. Mapping and assessment of climate hazard exposure levels across our facilities

As first step in ensuring long-term resilience of our

operations, we conducted a comprehensive climate hazard

exposure assessment across 83 facilities, comprising of 4 head

offices, 28 distribution centers, and 51 Robinsons malls where

a significant number of our stores are located. This

assessment focused on four key climate hazards: flooding, sea

level rise, extreme heat, and tropical cyclones. We leveraged

geospatial mapping to pinpoint the location of each facility

in relation to potential climate hazards which allowed us to

assess the corresponding level of climate exposure for each

facility. This crucial first step has enabled us to prioritize

facilities that require a deeper vulnerability analysis.

Key findings reveal that 48% of facilities are at high flood

hazard levels, 19% in low-lying coastal areas may face sea

level rise impacts, 8% are exposed to high heat hazards, and

8% to high tropical cyclone risks, highlighting distinct

vulnerability profiles across locations.

d. Climate vulnerability of the pilot facility

To optimize our climate risk adaptation strategies and

resources, we selected a pilot facility for a detailed

vulnerability assessment. The selection of the pilot facility

prioritized the facility with medium to high climate hazard

exposure, critical importance to our business, and resource

buy-in from the business unit head and facilities managers.

The chosen pilot facility, which is the Sucat Mega

Distribution Center of the Supermarket segment, underwent an

in-depth vulnerability assessment, employing a range of

advanced methodologies. These included:

- Tropical Cyclone Wind Modeling & Structural Analysis: We modeled the potential intensity of tropical cyclones against each facility's wind design threshold. This detailed analysis identified vulnerable areas and helped us quantify potential damage risks.

- Increasing Temperature & Energy Modeling: Rising temperatures were simulated to forecast the impact on energy consumption within each facility, helping us optimize cooling systems and energy management.

- Flood Modeling Assessment: We projected precipitation changes and used hydrological and hydraulic modeling to understand their potential impact on facilities, allowing us to plan flood mitigation measures.

This assessment provides actionable insights for enhancing our

climate resilience. We now have a robust understanding of the

specific vulnerability of the pilot facility and allows us to

tailor risk mitigation strategies, make targeted investments

in structural upgrades, and develop contingency plans. Our

commitment to this data-driven approach ensures that we

protect our assets and ensure business continuity amidst

increasing effects of climate change. The results of this

detailed assessment will be duplicated in the coming years for

other business-critical and highly vulnerable facilities to

climate hazards.

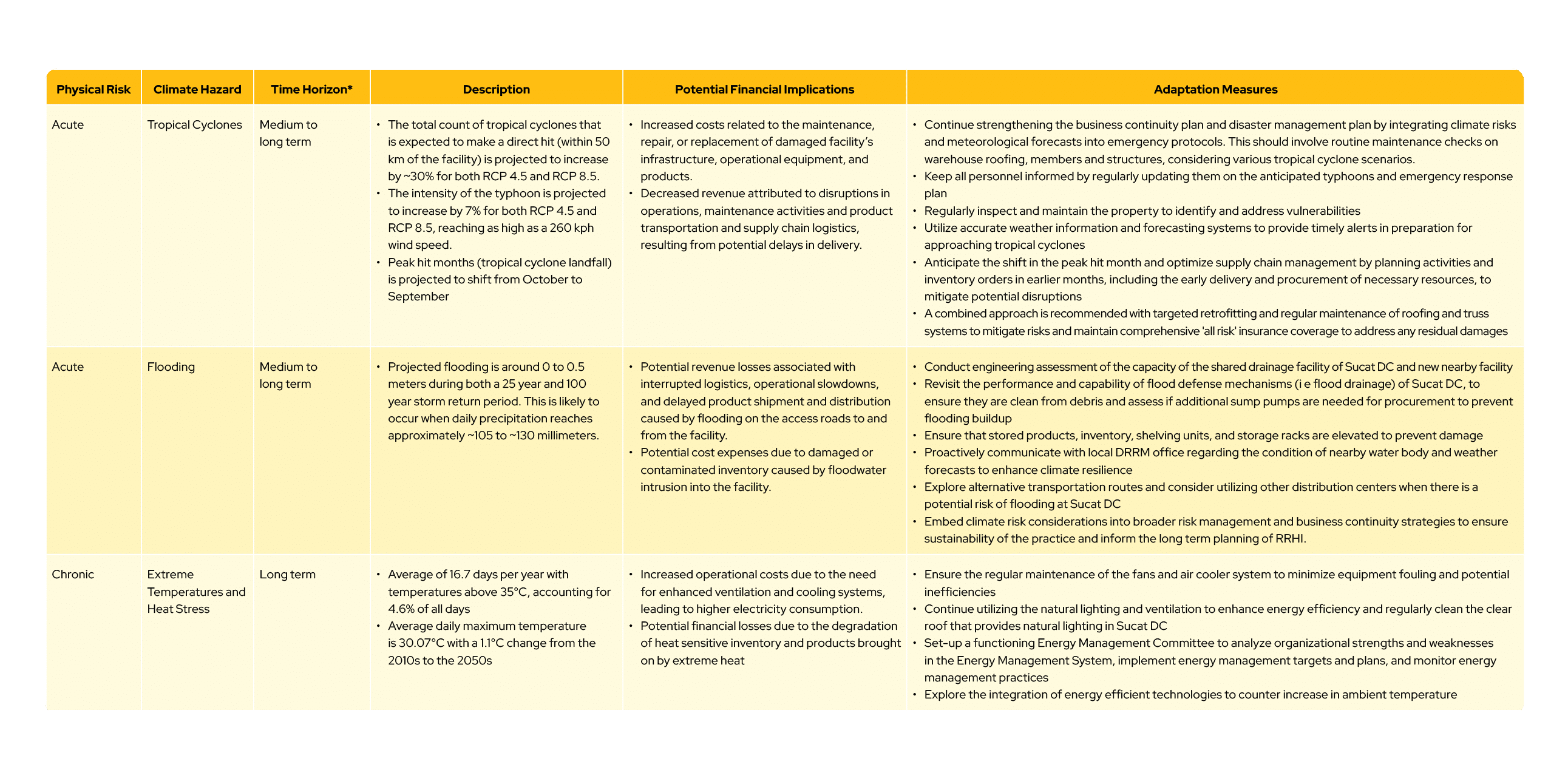

The table below provides an overview of the key climate risks

identified for each facility, along with their potential

financial implications.

Material Climate-related Physical Risks of Sucat Mega DC

*Short term: 1-5 years (2025-2029), Medium term: 6-15 years (2030-2044), Long term: 16 years and beyond (2045 onwards)

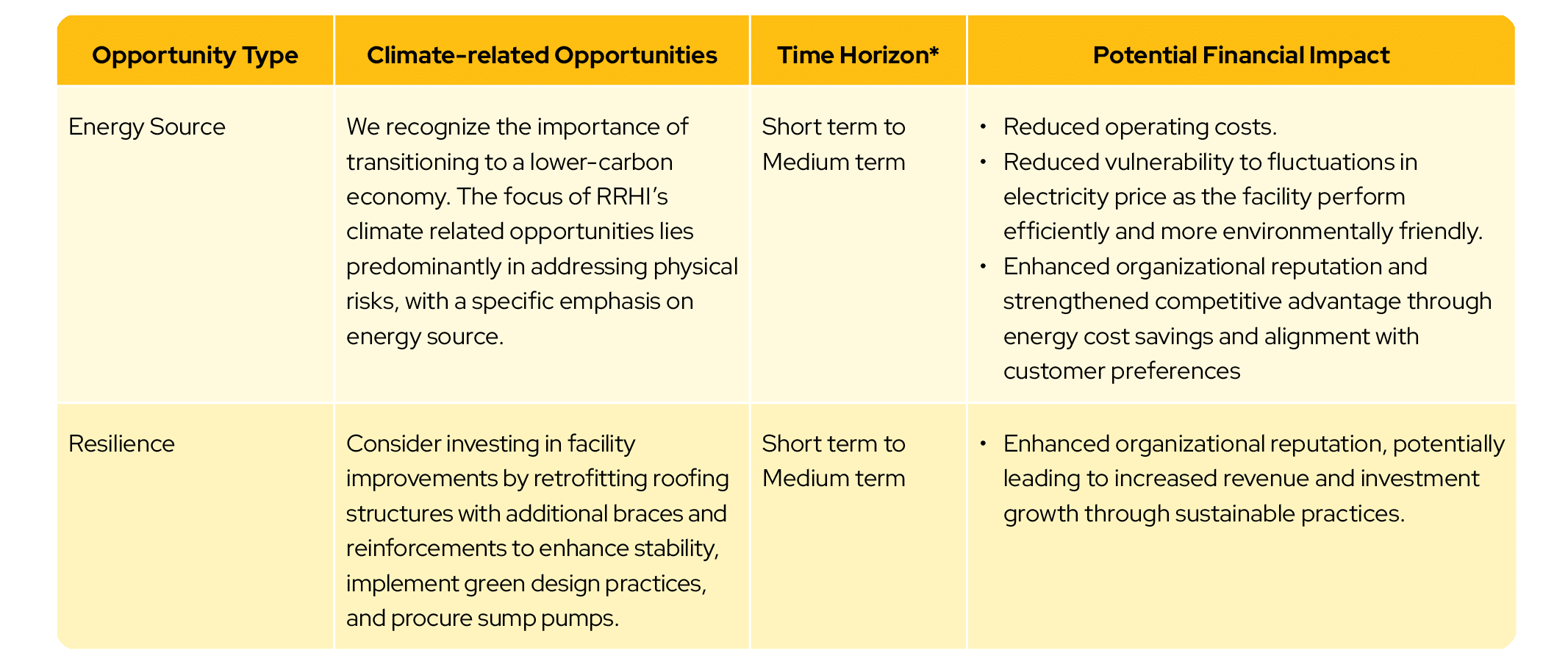

We recognize the importance of transitioning to a lower-carbon economy. The focus of RRHI’s climate related opportunities lies predominantly in addressing physical risks, with a specific emphasis on energy source.

*Short term: 1-5 years (2025-2029), Medium term: 6-15 years (2030-2044), Long term: 16 years and beyond (2045 onwards)

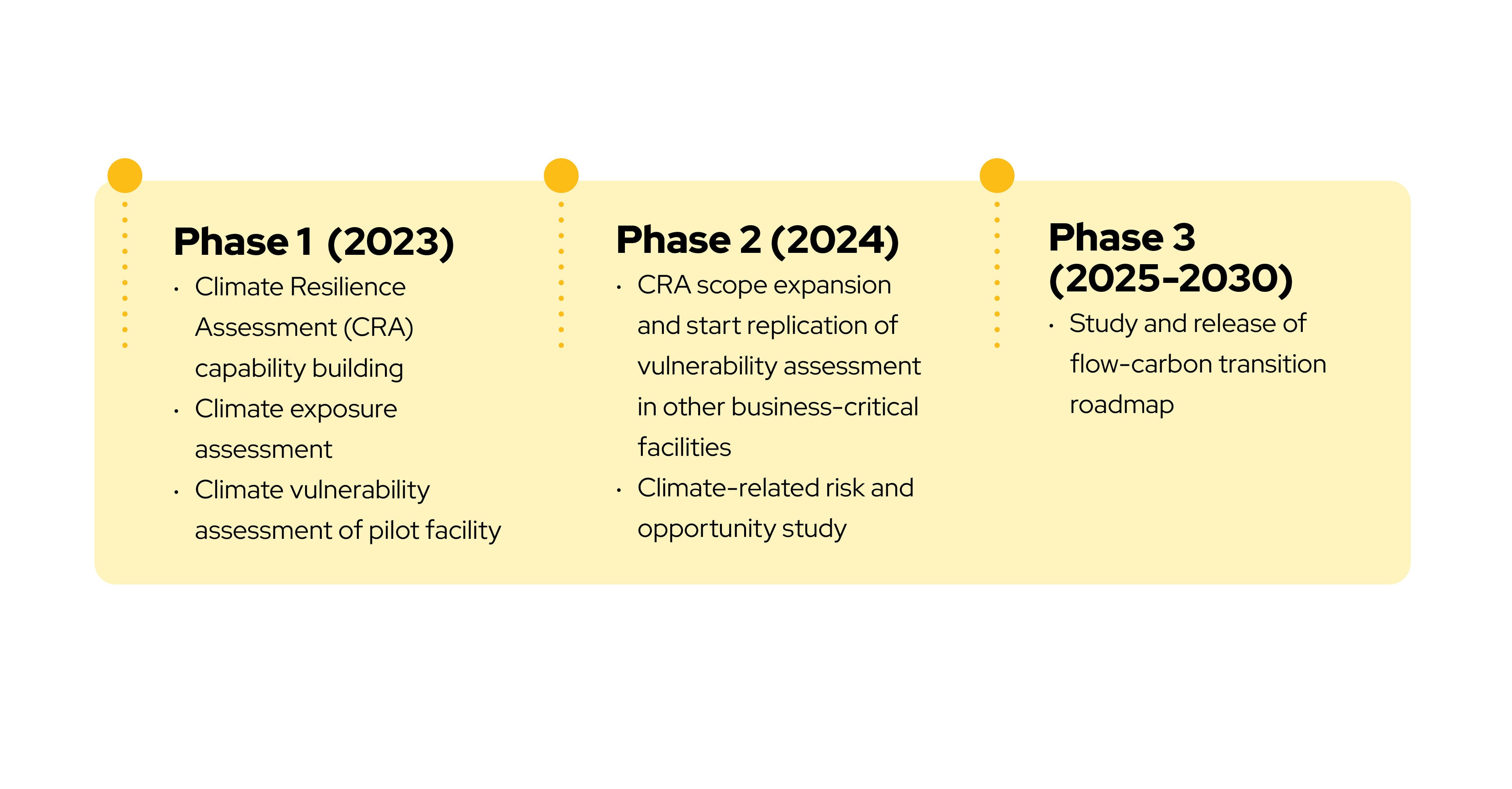

Climate Action and Resilience Strategic Roadmap

Recognizing the dynamic nature of climate science, we commit to regularly evaluate the robustness of our climate strategy. This ensures our operational practices and investments align with sustainability and climate resilience goals. Within 2025 to 2030, we plan to release our low-carbon transition roadmap that includes the result of transition risks assessment. This proactive approach will help us mitigate risks while also identifying new prospects within the growing climate-resilient marketplace. Through proactive risk management and strategic foresight, we strive to ensure the long-term resilience and sustainability of our operations and the broader value chain.

The timeline focuses on assessing climate risks, integrating climate resilience into business practices, and developing a low-carbon transition roadmap.

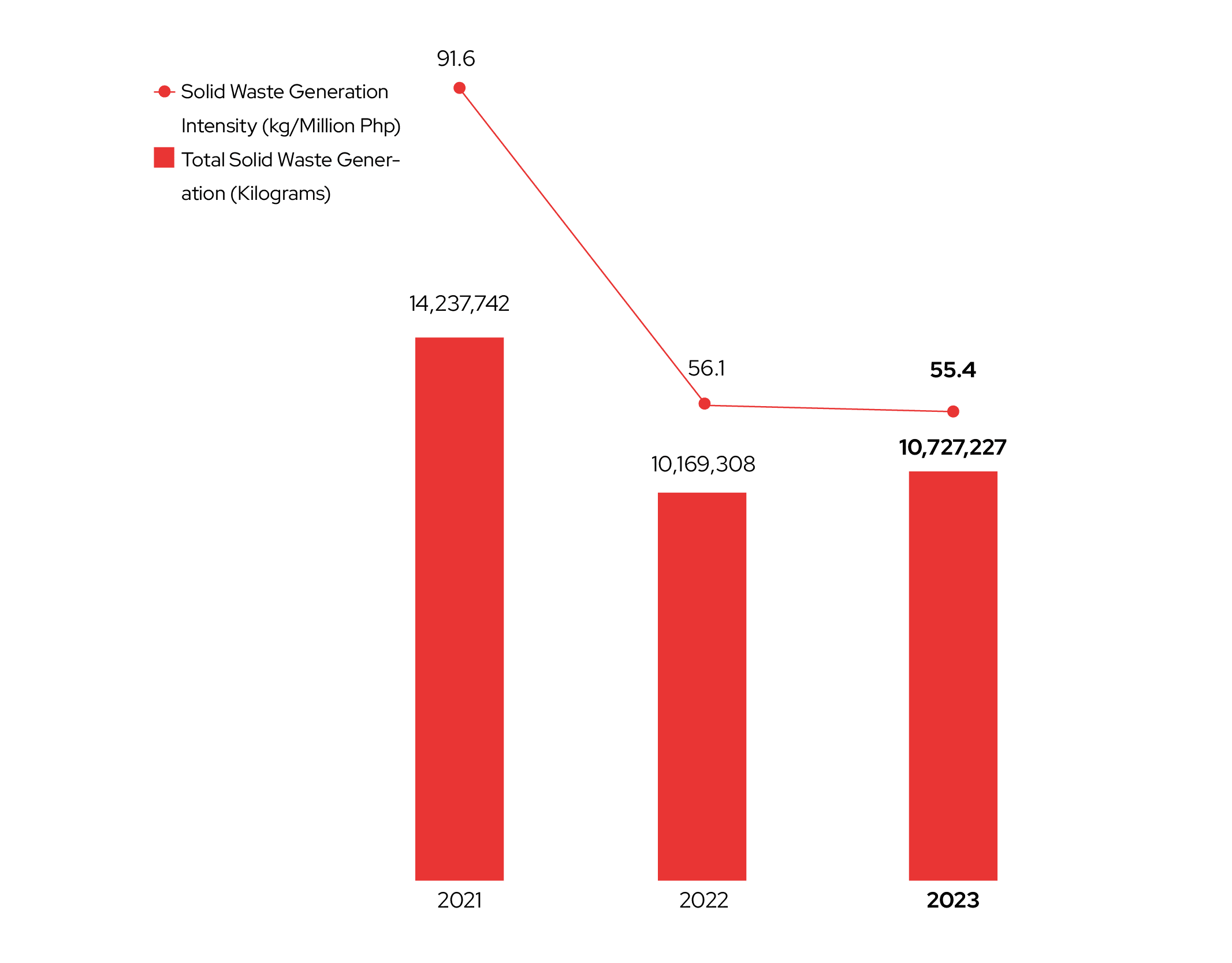

Solid Waste Management

We continue to implement effective waste management through

segregation measures. We aim to streamline our processes by

implementing standardized practices across all banners,

ensuring consistency and efficiency in handling solid waste.

To bolster our efforts, we are dedicated to systematizing the

collection and analysis of solid waste generation data. By

establishing a comprehensive data-gathering system, we gain

valuable insights that will inform our waste recycling and

diversion targets. This strategic approach empowers us to

optimize our waste management practices and minimize

environmental impact.

Materials Consumption

We are dedicated to responsible usage of plastic for consumer

packaging across our operations. Our strategy involves

continuous monitoring of plastic consumption, enabling us to

track usage patterns and identify areas for improvement. By

implementing proactive measures, we strive to steadily reduce

our resilience to plastic materials while ensuring the

sustainability of our packaging practices.

In 2023, we achieved a 51% decrease in non-renewable materials

consumption intensity. This reduction reflects our dedication

to minimizing our environmental footprint and transitioning

towards more sustainable practices.

We have identified opportunities to optimize resource

utilization across our operations. By implementing innovative

solutions and embracing alternative materials, we have been

able to streamline our processes while simultaneously reducing

our reliance on non-renewable resources.